The global monetary system (the US Dollar Standard) is failing. That should be pretty obvious by now, but if you’re in any doubt, take a look at the US National Debt Clock: at the time of writing, US National Debt is increasing by $100,000 every 2 seconds while tax revenue (money coming in to repay the debt) is decreasing by $100,000 every 13 seconds. This simply isn’t sustainable, and it’s just the beginning…

The economy still hasn’t been hit with the full effects of over 20% unemployment and the enormous strain this will put on social security, not to mention the titanic bailouts that will be required to rescue businesses and industries crippled by the CCP virus, and the next banking and pension fund crisis that will unfold as people increasingly default on credit card, auto, student and mortgage debt.

Now if you’re a Keynesian economist or subscribe to Modern Monetary Theory (MMT), you probably think this can all be solved by printing even more money. This arrogance is why we are where we are today – over the last two economic cycles, Central Bankers (dominated by Keynesian’s) congratulated themselves for “avoiding” otherwise more severe recessions by printing money. But in doing so, they inadvertently created a real-estate bubble to ease the impact of the dot-com stock crash, then a bond bubble to ease the impact of a real-estate crash.

Economists of the future will no doubt look back at this time and conclude that The Fed’s actions over the last two decades didn’t avoid more severe recessions, it merely delayed and compounded them. In its effort to outsmart the free-market, The Fed has created the mother of all bubbles – the stock, bond and real-estate bubble!

A return to normal, free-market price levels will require either a) stocks, bonds and real-estate to deflate, or b) wages and consumer prices to inflate. Either way, the ratio of wages and consumer prices to financial assets must re-balance. However, the banking system will implode if the assets underlying their loans collapse, so central banks are doing all they can to engineer scenario b).

“If the American people allow private banks to control the issuance of their currency, first by inflation and then by deflation, the banks and corporations that will grow up around them will deprive the people of all their property until their children will wake up homeless on the continent their fathers conquered.”

This quote from Thomas Jefferson, 3rd President of the United States, over 200 years ago succinctly describes what is unfolding in the US and world economy today. The Fed and central banks across the world have systematically inflated stocks, then property and then bonds, and are now trying to “save” the economy with bailouts and asset purchases using money (credit) they whipped up out of thin air. But they’re not saving the economy at all, they’re surreptitiously depriving the people of all their property (by purchasing it) under the guise of fighting deflation, enriching the banks and corporations that have grown up around them in the process.

At the time of writing The Fed owns over $1.7 trillion of mortgage backed securities e.g. it is effectively the largest real-estate magnate in the history of mankind. It’s also rear-ended the bond market by purchasing just under $4 trillion of treasury securities, a number that his increased by 50% in the last MONTH, and there is talk of legislation changes that would allow The Fed to purchase stocks just like Japan’s Central Bank (not that it needs to purchase equity, it can control the corporate world through bailout conditions if it really wants to).

So given that The Fed has, or at the very least IS in the process of depriving the people of all their property, the pertinent question is how did some guy (Jefferson) know this would happen over 200 years ago before The Federal Reserve or central banking system was even conceived?

Answer: he understood money and credit, and the difference between them.

THAT’S IT. Seemingly nothing complex, and it isn’t, yet if you ask any so-called finance professional, economist or banker to define and/or articulate the distinction between money and credit, they’ll almost certainly describe something that simply doesn’t make sense in the real world.

I’ll even go one step further and assert that you will not be able to find a single textbook on economics or finance that correctly defines money and credit. How is that possible? Because money hasn’t existed in the global economy for almost 50 years. This will hopefully make sense when you understand the definitions that make sense:

Credit is a public utility that acts as a medium of exchange and a unit of account, and has the properties of being portable, durable, divisible and fungible. Money is also a public utility that acts as medium of exchange and a unit of account, with the same properties as credit plus an additional (and very important) one: money is a store of value.

Fiat currencies across the globe (dollars, pounds, euros etc) are credit, not money. They can be typed into existence on central bank computers in unlimited quantities, and as this occurs, the value (purchasing power) of each existing unit decreases, not immediately, but over time, giving a purchasing power advantage to whoever has priority access to newly created credit (e.g. governments and the ultra wealthy). Fiat currencies do not store value. We have a global credit system, not a global monetary system, and the implications of this are huge.

Probably the most important inference is on the notion of “savings”. The purpose of saving is to defer consumption, and in order to do that, you need something that is a risk-free store of value: money. Without money, you cannot save, you can only invest. When you put credit in a “savings” account at the bank, you’re not saving, you’re investing. Your deposit is effectively a loan to the bank, and the interest you earn is your compensation for lending the bank your credit. The bank can default on your loan at any time so your “savings” are not risk-free, and therefore aren’t savings at all!

You cannot preserve the purchasing power of credit without risk. You can only invest it, and hope that your returns exceed the inevitable loss of its purchasing power.

The distinction between money and credit, and recognition that it’s only possible to save a risk-free store of value (money), is the foundation of the Efficient Economy Hypothesis: a monetary system in which money and credit are distinct but fungible assets, and in which rates of return are market-driven, will smooth the business cycle by minimizing asset bubbles and malinvestment.

What would such a system look like?

First, we need something to function as money, and there is simply no better candidate than gold since the government of every major economy has gold reserves equal to around 5% of their respective GDP, and around 70% of global gold is held by the private sector, so it’s relatively well and evenly distributed around the world.

Next, we need credit, a role could be performed by a government-sanctioned cryptocurrency. This should set alarm bells ringing for a variety of reasons, high among them being the fact that taking the power of credit creation away from banks and giving it to politicians, a group that is almost as greedy but half as smart, creates an enormous conflict of interest between responsible economic management and irresponsible election promises to stay in power.

But what if new credit wasn’t directly available to politicians? What if it had to be distributed evenly across the population? Money and credit are, after all, public goods (unless you believe in fascism). Thanks to the wonders of blockchain, we have, for the first time in history, the ability to distribute credit from the bottom up rather than top down. In practical terms, this would mean that if the government of economy A, with a credit supply of $25 trillion and a population of 330 million people, wanted to increase the credit supply by 10% ($2.5 trillion), it would do so by issuing $7,575 to each citizen.

This creates a powerful dynamic that limits the potential for government overreach, and restricts its ability to manipulate the free-market (this will become clearer as we move on).

The next piece of the puzzle is understanding how money and credit interact. The hypothesis states these assets should be fungible (mutually interchangeable), but how? Who or what determines the exchange rate between gold and dollars? Answer: grade 1 arithmetic. We know around 190,000 tonnes of gold (6.7 billion ounces) has been mined throughout history. Therefore an ounce of gold in economy A would be $3,731 (25 trillion divided by 6.7 billion)

If the government of economy A increased the credit supply by 10%, gold would re-price to $4,104. Similarly, if the credit supply increased by 10% and an additional 3,000 tonnes were mined (typical amount mined annually), the price would be $4,044. In the scenario where the government leaves the credit supply unchanged and the global gold supply increases, the value of gold would decrease to $3,676 ($25 trillion divided by 6.8 billion), implying that gold isn’t storing its value.

This could easily be remedied by a “compulsory” periodic distribution of new credit equal to the percentage increase in gold e.g. 3,000 tonnes of “new” gold equates to 1.58 percent of global gold reserves. The currency supply would therefore need to increase by $395 billion (0.0158 multiplied by $25 trillion) by distributing $1,197 to each citizen.

In the above described system, citizens can choose what to do with any excess credit they do not wish to spend immediately – they can save (buy gold) or invest. Their choice will largely depend on two factors: first, the expected rate of government credit expansion; and secondly, the expected rate of return on investment.

If the government is expanding credit at a rate higher than the expected return on investment, is makes more sense to save (buy gold) than invest. Alternatively, if the government’s rate of credit expansion is less than market returns, it makes sense to sell gold and invest.

Under our current (failing) system, interest rates are arbitrarily determined by a consensus of central bankers. This is absurd when you think about it. First of all, with an unlimited supply of credit, rates are always artificially low, encouraging malinvestment by definition, which ultimately causes or at the very least exacerbates the severity of business cycles. Secondly, economists broadly agree that the free-market best determines the optimal allocation of limited resources, yet the cost of credit used to facilitate resource allocation is anything but free.

In practice, free-market interest rates in the Efficient Economy would be determined by a vibrant industry of investment funds that would replace the investment and lending function of banks and other financial institutions. Each fund would compete for excess credit to make equity investments or loans in the old “3-6-3” banking fashion. Except, with a limited supply of credit at any given time, and no bailout mechanism, funds would need to carefully manage risk in order to maximize returns.

Over time, excess credit would gravitate to the most successful funds, however as funds increase in size, their ability to maintain high returns diminishes as marginal returns decrease. This favors smaller funds that are diversified within a focused area of expertise, and ensures overall capital allocation is optimized while returns are more evenly distributed across the economy.

Note that there is no distinction between rates of return on equity and debt investments. Funds can structure themselves to accommodate any combination of risk, duration and liquidity preferences. Ultimately, it doesn’t matter, as aggregate savings and investment is driven by the rate of government credit creation relative to aggregate market returns, regardless of whether returns are derived from equity or debt investments.

Unlike our current system, the Efficient Economy ensures that credit creation is aligned with real economic growth, be it through population or productivity growth. This prevents, or at the very least minimizes, the potential for asset bubbles to form, therefore minimizing the severity of business cycles. Let’s explore this with an example contrasting both systems:

Let’s start with an economy that is in equilibrium and assume that some form of innovation in the technology sector generates efficiency gains across the entire economy as the evolution of the internet did back in the 90’s. As companies embrace new technology, they’re able to improve efficiency and lower costs, putting deflationary pressure on the economy as increasing margins attract new businesses to compete for profits. Importantly, this also spurs an increase in the velocity of credit as economic activity surges, giving rise to competing inflationary and deflationary forces.

Here we see credit velocity increasing through the 90’s:

Yet inflation remains relatively stable, as deflation from productivity improvement offsets inflation from accelerating credit velocity:

The result is an over-supply of credit, as it’s provided in unlimited quantities at an arbitrarily determined rate, and because it’s issued “top-down”, the benefit of spending it accrues disproportionately to the 1% class, since they get to spend it before it trickles down through the economy and causes prices to inflate. But as we observed above, prices didn’t inflate, so where did all the excess credit go?

Here:

S&P 500

and here:

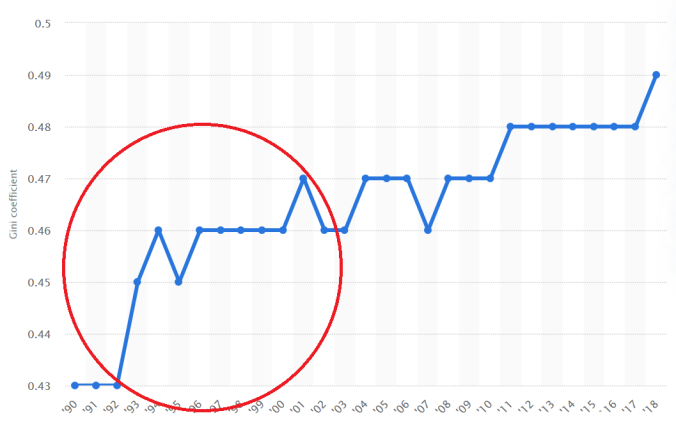

Not surprisingly, inequality (the wealth gap between the rich and the poor) increased throughout the 90’s:

source: https://www.statista.com

At this point let’s pause and think about what impact a technology improvement should have had on the economy:

Given a fixed supply of money, we’d expect prices to fall as technology improves efficiency across the board, and any short-term increased margins are eroded by greater competition. This should also translate into a short-term increase in equity values, followed by a decrease such that overall equity prices remain broadly unchanged. Similarly, housing should remain unchanged, or cheaper if anything, as the cost of building materials would have decreased.

Overall, wealth inequality should have decreased, not increased, as cheaper goods disproportionately benefit the poorer members of society. For example, if the price of bread drops from $1 to 80 cents, it really doesn’t impact the billionaire class, however it can materially benefit those getting by on $500 per month.

The reason we ended up with the complete opposite impact on the economy (higher prices, disproportionately higher stock and real-estate prices, and increased wealth disparity) is purely the result of a monetary system without money or free-market interest rates, and unlimited credit distributed top-down.

Now, to be fair, a system with a fixed money supply wouldn’t have been able to achieve the desired outcomes described above (stable asset prices, cheaper consumer goods and reduced inequality) as prices are downward sticky, and if the market anticipates deflation, they defer consumption (save), which crowds out investment, reduces the velocity of money, and seizes up the economy. Fail.

This is why the gold standard is (rightly) criticized. A fixed supply of money simply doesn’t offer the flexibility needed for an economy to grow. On the flip side, an infinitely elastic credit supply, issued top-down at an artificially low rate, distorts market prices, encourages malinvestment, and drives inequality.

The Efficient Economy Hypothesis is effectively a Quasi-Gold Standard that addresses the flaws of both systems. Let’s look at how the same scenario (a global technology improvement) would unfold:

We begin at an arbitrary level of equilibrium, which in this case, means the government is creating credit at a rate that aligns to the market e.g. the return on investment is equal (or perhaps at a slight premium) to the return on savings (holding gold) such that there is no net increase or decrease in the demand for gold.

Remember, if there is an increase in demand for gold (savings), it’s a signal that the government is creating too much credit, and consumers who wish to preserve the purchasing power of any excess credit they have, would do so by saving (trading in credit for money).

Likewise, if consumers are selling gold to the government on aggregate, it’s a signal that they think they can increase their wealth by investing e.g. if gold is $100 per ounce and the government is creating new credit at a rate of 5%, but investors think they can earn 10% by investing in a fund, they’ll sell gold, invest $100 and at the end of the year they’d have $110 which could be used to repurchase gold at $105 and they’d have $5 more than if they’d saved.

From a state of equilibrium, a technology improvement would increase demand for credit, as both new and existing companies need capital to start-up, expand or restructure operations. This drives up the market rate of return. Let’s say it moves up from 5% to 6%. As it’s bid upwards, more and more consumers switch from saving to investing as the opportunity cost of saving increases. The higher the gap between the market rate of return and the government’s rate of credit creation, the greater the incentive to sell gold and invest credit for a superior return.

As the government accumulates gold, it faces increasing pressure to supply more credit to the economy. Our 320 million citizen economy with a credit supply of $25 trillion would increase it’s distribution of new credit from $3,906 ($326 per month) to $4,687 ($391 per month) to achieve this incremental 1% increase in the rate of credit creation, incentivizing more people to choose saving over investment.

Under the Efficient Economy Hypothesis, “equilibrium” occurs at a point where the government’s rate of credit creation aligns with the market rate of return such that there is no net demand from citizens to either buy or sell gold. This ensures that the supply of credit is always aligned to the growth of the real economy, preventing the asset bubbles that have historically sparked the most devastating economic crises.

The fungible money-credit mechanism also acts as a natural automatic stabilizer on the economy. In our example, the technology advance increases demand for private sector funding, which reduces the government’s spending capacity as its credit reserves are drained by gold purchases. In the reverse scenario where market returns decease to a level below the government’s rate of credit creation, citizens would revert to buying gold to preserve purchasing power, which would in turn give the government extra credit to implement any desired fiscal stimulus deemed necessary to rejuvenate the economy.

At this point, let’s divert to taxes as this adds a unique element to the “efficient” in The Efficient Economy Hypothesis.

Governments typically impose a combination of corporate and personal income taxes to fund their spending (or to control inflation if you subscribe to MMT). Either way, the implementation of taxes involve a complex set of rules that are exploited by a cottage industry of accountants and lawyers to minimize the legal amount of tax they need to pay. Billions of dollars are spent on tax compliance each year, yet none of these ancillary services add a single iota of value to the economy. Taxation under our current monetary system is extraordinarily inefficient.

A government-sanctioned distributed ledger for the issuance of credit would enable the elimination of personal income taxes in favor of a progressive transaction tax that could be automatically levied on each and every transaction. This may appear no different to a goods and services tax or VAT, however as it’s applied automatically and remitted immediately to the government rather than the seller, collection costs and exposure to fraud is virtually eliminated.

Similarly, transaction taxes could replace corporate taxes, and could be applied at different rates according to transaction size, business type, industry, or some other distinguishing feature. Aside from reducing collection costs and tax evasion to almost zero, it enables the government to track economic activity in real time and respond quickly and effectively to changing trends in credit velocity. This means that the rate of credit creation is aligned as close as possible to the productivity of the economy.

This is infinitely superior to our current system where rates are determined by a committee of Central Bankers using data that is months out of date. Instead of rates adjusting to the market, the market adjusts to arbitrarily determined rates at which new credit is created in unlimited quantities and issued to a relatively small group of “secure” borrowers. The asininity of this is mind-boggling.

Yet, every. single. mainstream. economist – whether they subscribe to Keynesian, Austrian, MMT, or some other school of thinking – blindly accepts the notion that money is credit, and credit is simply some kind of accounting mechanism used to facilitate transactions. Austrians argue the money supply should be inelastic (fixed), Keynesian’s/MMT folks argue it should be elastic. Based on these one-dimensional views of money and credit, they each seek to explain how governments should respond to fluctuations in the business cycle:

Austrians advocate minimal government intervention, that with a fixed money supply would cause asset, consumer prices, and wages to fall over time in order to maintain equilibrium. Keynesian’s and MMT folks (who are basically Keynesian’s on steroids) advocate for an elastic credit supply that gives the government unlimited capacity to inflate prices back into balance. Unsurprisingly, Keynesyian’s (and increasingly MMT folks) dominate mainstream economics, as governments are understandably partial to the idea of playing god over the economy.

In reality, none of these views are incorrect within the scope of the monetary systems they prescribe, but what if business cycles were caused by these one-dimensional monetary systems themselves? Under an elastic credit supply, assets inflate against wages and consumer prices until the resulting asset bubbles pop, and under a fixed money supply, the downward stickiness of wages and consumer prices prevent the efficient adjustment of prices to keep the economy in equilibrium, resulting in periodic deflationary busts.

The Efficient Economy Hypothesis recognizes that a monetary system needs both elastic (credit) and inelastic (money) components to function efficiently. With both money and credit recognized as distinct yet fungible assets, traded at rates determined by the market, in a largely decentralized system where new credit is treated as a public good and therefore distributed bottom-up rather than top-down, the propensity for business cycles to occur is reduced immensely if not eliminated completely.